With ICS® and CDARS®, you can access multi-million-dollar FDIC protection by working directly with us.

- Rest assured. Know that deposits well into the millions are eligible for FDIC insurance protection. Because deposit accounts are not subject to floating net asset values, market volatility will not negatively impact principal.

- Earn interest. Put cash balances to work in demand deposit accounts, money market deposit accounts, or CDs.

- Keep it simple. Avoid opening multiple accounts with multiple institutions to protect your funds. Forego the need to use repo sweeps, track collateral on an ongoing basis, and manually consolidate statements and disbursements from multiple banks.1

- Manage liquidity. Enjoy access to funds placed into demand deposit accounts and money market deposit accounts. With CD placements, select from multiple terms to meet your liquidity needs.

- Support your community. Feel good knowing that the full amount of funds placed through ICS and CDARS can stay local to support lending opportunities that build a stronger community.2

Frequently Asked Questions

Q: Before I decide if I need ICS-CDARS, how much FDIC insurance coverage do I qualify for?

A: The standard deposit insurance amount is $250,000 per depositor, per FDIC-insured bank, per ownership category. You can learn more about the types of insurable deposit products that are covered by FDIC insurance and the amount of deposit insurance coverage that may be available under FDIC's different ownership categories by reviewing the FDIC's Your Insured Deposits brochure.

Q: Is the program available to individuals and businesses?

A: Yes, the program is open to both individuals and businesses.

Q: Can I pick and choose the financial institutions that my deposits go into?

A: While you can't select the financial institutions that your deposits go into, you can exclude financial institutions where you already have a relationship to ensure that your placements do not exceed the FDIC insurance limit.

Q: Is there a way that I can see where my funds are?

A: Yes, for money placed in CDs, you will receive a statement after the CD is opened and it will include where your funds have been placed. For money placed in a checking or money market account through the ICS program, you can access this information via the Depositor Control Panel, an online system provided by the program administrator. This portal allows you to view account balances, monthly statements and 1099 tax forms. You can enroll to use the Depositor Control Panel by registering online using the following link - www.depositorcontrol.com

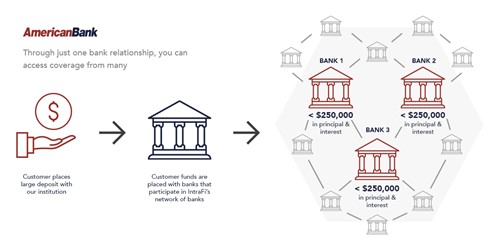

Q: How does the sweep service work?

A: As participant bank in the ICS program, an American Bank customer enrolled in the program with deposits in excess of the $250,000 FDIC insurance limit will have the excess balances from their checking or money market accounts automatically allocated to other FDIC insured accounts held at other banks in the program. This specialized technology helps protect your accounts with millions in FDIC insurance while having access to the entire balance on a daily basis.

Here's an example:

- An American Bank customer has a checking or money market account with a balance of $1,000,000:

- The first $250,000 is allocated to American Bank.

- The next $250,000 is allocated to Bank A in the network.

- The next $250,000 is allocated to Bank B in the network.

- The next $250,000 is allocated to Bank C in the network.

- Any amount greater than $1 million - due to interest earned or deposits made - will automatically be allocated to the next bank in the program to ensure that the entire balance is fully FDIC insured.

Q: What interest rate will I receive on my account?

A: You will receive the interest rate that you are currently getting on your American Bank checking or money market account. Please contact us for the current interest rates available on CDs through the CDARS program.

Q: Will I receive a monthly statement?

A: Yes, you will still receive your monthly deposit account statement from American Bank for your checking or money market accounts but you will also receive a monthly statement from the program administrator. This statement can also be accessed online via the Depositor Control Portal and will be available the first day of the month.

Q: Can I make deposits and/or withdrawals from the checking or money market accounts enrolled in the program?

A: Yes, you can make deposits and/or withdrawals at any time by contacting us and completing a Transaction Request Form. Requests must be made by 2:00 pm to be processed the same business day.

Q: How do I enroll in the ICS program?

A: Enrolling in the program is easy...contact us and follow these straightforward steps:

- You sign a Deposit Placement Agreement and a custodial agreement with us.

- You identify an existing deposit account (or set up a new one) to be used with the program.

- Your funds are placed into deposit accounts at other participating banks in the program.

- You can check balances and see where your funds are at all times using the Depositor Control Panel.

- You receive a consolidated monthly statement from us.

Q: How do I open a CD through the CDARS program?

A: Enrolling in the program is easy...contact us and follow these simple steps:

- You sign a CDARS Deposit Placement Agreement and a custodial agreement with us, and then invest money with us.

- Your funds are placed using the CDARS service.

- Your CDs are issued by other banks within the program.

- You receive confirmation of your CDs from us.

- You receive interest payments and statements from us.

Q: What happens if one of the participating banks fails?

A: If a participating bank fails and a successor bank is named, there is no need to take action since the bank will continue to function normally. If a successor is not named, the program administrator will create an FDIC claim data file and associated paperwork. Upon receipt of the money from the FDIC, funds will be posted to the American Bank accounts and reallocated among remaining participating banks.

Q: What happens if this program is terminated?

A: If the program is terminated, all funds are returned to the account holder from the participating banks.

1 If a depositor is subject to restrictions with respect to the placement of funds in depository institutions, it is the responsibility of the depositor to determine whether the placement of the depositor’s funds through ICS or CDARS, or a particular ICS or CDARS transaction, satisfies those restrictions.

2 When deposited funds are exchanged on a dollar-for-dollar basis with other institutions that use ICS or CDARS, our bank can use the full amount of a deposit placed through ICS or CDARS for local lending, satisfying some depositors’ local investment goals or mandates. Alternatively, with a depositor's consent, our bank may choose to receive fee income instead of deposits from other participating institutions. Under these circumstances, deposited funds would not be available for local lending.

Deposit placement through CDARS or ICS is subject to the terms, conditions, and disclosures in applicable agreements. Although deposits are placed in increments that do not exceed the FDIC standard maximum deposit insurance amount (“SMDIA”) at any one destination bank, a depositor’s balances at the institution that places deposits may exceed the SMDIA (e.g., before settlement for deposits or after settlement for withdrawals) or be uninsured (if the placing institution is not an insured bank). The depositor must make any necessary arrangements to protect such balances consistent with applicable law and must determine whether placement through CDARS or ICS satisfies any restrictions on its deposits. A list identifying IntraFi network banks appears at https://www.intrafi.com/network-banks. The depositor may exclude banks from eligibility to receive its funds. IntraFi and ICS are registered service marks, and the IntraFi hexagon and IntraFi logo are service marks, of IntraFi Network LLC.